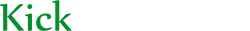

MarketGauge – ETF Sector Plus Strategy

Original price was: $1,497.00.$197.00Current price is: $197.00.

Product Delivery – You will receive Content Access Via Email.

Email – [email protected]

Description

MarketGauge – ETF Sector Plus Strategy

Sale Page :http://www.marketgauge.com/etf/web/

Trade ETF Sector Trends Like A Pro

To Build Your Wealth and Income.

Regardless of The General Market Trend!

Decades of…

- Trading experience,

- Market research, and

- Technological development

…have been combined to give you access to trading strategies historically reserved for only the savviest hedge funds!

And profiting from this strategy is as easy as holding 3 ETF positions!

Register now and you’ll immediately receive the top three ETF’s that the“ETF Sector Plus Strategy” has selected to dramatically outperform the markets right now.

Start Your Full Year Membership Now

YES, I want to be part of this exclusive program so that I’ll receive immediate access to the ‘ETF Sector Plus Strategy’ before the price goes up!

YES, I want to be part of this exclusive program so that I’ll receive immediate access to the ‘ETF Sector Plus Strategy’ before the price goes up!

Here’s What I’ll Receive With My Membership…

A Full Year of Access To:

|

Early Notice Trading Alerts via Email and Text Messaging These alerts will tell you exactly when and how to follow the trades of the ‘ETF Sector Plus Strategy’. This will enable you to get the new trade ideas the day before the strategy enters the trade! |

|

The ETF Sector Plus Model Portfolio The model portfolio ensures you know exactly what is happening with the model. You’ll be able to easily track all open positions, recently closed positions, even the daily movements of the models underlying ETFs, and more.You’ll love this detailed monitoring if you’re curious about which sector trends and trade opportunities are gaining and losing momentum! |

|

Daily Email Updates & A Weekend Strategy Review Daily emails keep you updated on the current Model Portfolio’s open positions, so you never miss a trade. This is in addition to any trade alert email. Plus, a weekend email teaches you more about the model and the markets! |

| A Live Monthly Training Webinar You’ll learn more about recent trades, current trends that may develop into trades, and you can ask questions and explore new ways to trade with the models trading alerts. |

The Automated ETF Sector Plus System

Provides Amazing Returns In Just Minutes Per Week

Traders of any ability can profit from the ETF Sector Plus Strategy by spending only a few hours a week to execute trades because…

| The trading model calculates exact entry and exits for trades so there is NO analysis required. | |

| All trade alerts are issued at the end of the day so you can literally set up your orders before the market opens. | |

| The model portfolio never holds more than three positions so there is very little management required. |

Why The 2015 Pullback In The Models’ Equity Curves

Is A BIG Opportunity Now!

We’re not going to try to hide the fact that 2015 was a rough year for the ETF Sector models, but the reasons behind it are over and very unusual, here’s why…

The majority of the negative performance in 2015 stems from the 3-day crash from August 19 to August 24th. In fact, on 8/19, right before the S&P’s historic 3-day slide our Moderate model was up about 1% for the year and in line with the market’s performance.

Unfortunately our sell signals occurred on 8/21. This means we exit long positions the next day which was the extraordinary gap on the 24th. This led to unusually bad exits.

The extreme gap also caused the model to switch into a short position at this same extreme level, and the next couple months this was also stopped out at a loss.

In prior “quick” corrections the model was positioned short prior to the bulk of the selloff or it had defensive positions such as bonds or gold so it was not hurt as much.

In conclusion, the model is designed to take advantage of declines that last longer than 3 crash days, and if the market had continued lower the model would have done quite well. Additionally, had the crash happened one day later, the models’ losses would be half of what they currently show.

As a result, of the 2015 and early 2016 sell off the models began a new cycle of Sector leadership, and 2016 has been one of the best years for the model and the year is long from over!

Its historic performance up to 2015 demonstrates that in any decent trend up or down it can easily and dramatically outperform the general market over time.

The trade alerts could not be easier. Here is what a typical trade alert will look like:

“ETF Sector Plus Strategy Trade Alert:

Buy GDX at the market on the open Monday 2/1/2016”

When you become a member you’ll be able to instantly replicate the model’s portfolio so you can start immediately to have your trades track the performance of the model’s equity curve!

You’re Also Protected By Our

100% Performance Guarantee

Your purchase today is protected by our 100% performance guarantee.

If the ETF Sector Plus Model Portfolio has not produced a positive return in your year of being a member, then the next year is free.

Aiden (verified owner) –

The course was very informative and well-structured.

Aadarsh (verified owner) –

This course is a must-have for anyone looking to learn this topic.

Alexander King (verified owner) –

The examples and case studies were very helpful.

Brandon Foster (verified owner) –

The content was well-presented and easy to understand.

Ryker (verified owner) –

Clear and concise explanations. This course is worth every penny.

Joshua Wilson (verified owner) –

I learned so much from this course. The instructor’s knowledge is impressive.